ABOUT MARINE INSURANCE

|

Because of this long tradition of marine insurance, certain codicils have developed which are so ingrained in the business that they are deemed to be implied, even if they aren't spelled out in a marine insurance contract. These are called implied warranties. One of these is the expectation that the policyholder will act with the 'utmost good faith' in providing all relevant information and avoid in every possible way the providing of false or misleading information to the underwriter of the policy. This arose because of the impracticality of underwriters making an independent investigation of the facts regarding a vessel that could be in any port in the world, or even at sea. It became understood that, if the business of marine insurance was to be viable, the underwriters of the insurance must be entitled to rely on the word of the owner of the vessel and should entitled to avoid payment of a claim if it is found that the underwriter was misled. Another implied warranty is the warranty of seaworthiness. Similar to the practicalities of the reliance on good faith, it is problematic for an underwriter to make an independent judgment of the seaworthiness of a vessel in every case, so it has come to be understood that this is an assurance the vessel owner must make to the underwriter. That is, the underwriter is entitled to expect the vessel insured to be outfitted, maintained and crewed in a manner expected to keep the vessel and its crew safe from the usually expected hazards it will encounter.

While such notions as good faith and good condition are expected in other

forms of insurance, it is in marine insurance that the expectation rises

to the level that a policy can be considered void if there is a

misrepresentation or the vessel is found to have been unseaworthy.

But as much as modern policies are more easily read and comprehended, the departure from the old standardized wordings has created a new challenge. This is because each insurance company has made its own changes to the wording and added their own customizations and special circumstances and exceptions. This has led to no two policies being alike, so, whereas in other forms of insurance like homeowners and automobile insurance where the wordings and coverages are essentially identical from company to company and one need only shop for the best price and claim service reputation, in marine insurance, boat and yacht insurance in particular, one must also consider the relative comprehensiveness and generosity of the policy offered. As outrageous as it may seem, a marine insurance policy was once found to have excluded from coverage losses arising from water! Imagine an insurance policy for a boat that didn't cover it if it sank!! That being said, though, there are circumstances in which a boat policy would not cover sinking, most often when the boat sinks due to the failure of a part suffering from gradual deterioration. Almost all policies covering any type of property, seagoing or otherwise, will exclude from coverage losses arising from normal wear and tear, corrosion, electrolysis, vermin and other sorts of gradual deterioration, this because such losses are foreseeable and preventable by appropriate inspection and maintenance. A somewhat related but less foreseeable class of losses are those arising from mechanical and electrical breakdown; some of the better insurance policies will cover these breakdowns, but only if they are not ultimately attributed to lack of maintenance and gradual deterioration. For a time after the famous Inchmaree case of an merchant ship boiler explosion in 1857, most policies covered these breakdowns, but in modern times most boat policies exclude mechanical breakdown and there are only a handful who do still afford this protection. These breakdowns that are covered by the better policies are typically caused by a defect within the machinery that is not discoverable by ordinary means of examination and maintenance and are called latent defects.

Most modern policies exclude coverage for the actual item that had the

latent defect, although that isn't much of an issue because the cost of

the item is more often than not well below the deductible amount that must

be exceeded before an

Besides that significant distinction among marine insurance policies, there are two other, perhaps more significant, classifications of such policies. One is the way a policy determines the amount of payment in the event of a total loss; policies are classified as either 'agreed value' or 'actual cash value'. Agreed value policies carry a lower risk to the policyholder because the amount that the payment is based on is determined and agreed upon at the time that the policy is issued rather than at the time of a claim. Actual cash value policies may or may not state a maximum amount of coverage provided, but, in any case, it is the insurance underwriter that determines how much is to be paid for the loss based on their judgments about how much the vessel was worth just prior to the loss. Obviously, leaving this determination of value up to the insurance company can allow the company to take advantage of their position and offer a lower amount to settle a claim than is fair. Another major difference among yacht insurance policies is how reimbursement amounts are determined for partial losses, that is, losses where repairs to the vessel are to be made. Some policies offer 'replacement cost protection' where reimbursement is made based on the actual cost of the items being replaced, even if that cost is more than what the lost or damaged items were worth, whereas 'actual cash value' policies will factor in the depreciation of the lost or damaged items and reimburse you based on that value, even if the cost to replace those items is higher.

The final major distinction among marine insurance policies is the approach to determining whether losses are covered by a policy. A 'named perils' policy was the more traditional form and does still exist to a limited extent today. In it, the types of occurrences that are covered are enumerated and anything not named is not covered. Considered to be generally more comprehensive and safer to rely on, 'all risks' policies, while not actually covering literally all risks, does start out with that premise. The policy wording will then go on to enumerate the types of loses that are excluded, and all policies will have at least a few such exclusions. However, by announcing in advance what will not be covered, a policyholder can be forewarned about what things to take extra precaution about avoiding, whereas, with a named perils policy that may seem comprehensive, there may be unstated gaps in coverage lurking.

Please feel free to contact any of the professionals at Manifest Marine for any further information you may care to have concerning marine insurance in general or how this financial security product can serve your needs in particular. |

Insurance, generally, is a contractual arrangement whereby the risk of

financial loss from sudden and accidental occurrences is transferred to a party willing to accept the future risk

in exchange for a set fee paid in advance. And, in fact,

Insurance, generally, is a contractual arrangement whereby the risk of

financial loss from sudden and accidental occurrences is transferred to a party willing to accept the future risk

in exchange for a set fee paid in advance. And, in fact,

In modern yacht insurance policies, the wording of which has generally

been updated to be more readily understood by the modern reader (while

still remaining Byzantine in many respects,) the warranties of

good faith and seaworthiness are often written into the policy wording

rather than being left as implied warranties.

In modern yacht insurance policies, the wording of which has generally

been updated to be more readily understood by the modern reader (while

still remaining Byzantine in many respects,) the warranties of

good faith and seaworthiness are often written into the policy wording

rather than being left as implied warranties. insurance claim payment would be made anyhow.

But the failure of even the smallest and least expensive item with a

latent defect can have disastrous consequences. Imagine a hose

clamp installed on the seawater cooling intake hose: whether it fails due

to progressive corrosion years later or fails the week it was installed

because it was not manufactured correctly, not only will a claim be

unsustainable for the loss of the hose clamp, but, if the boat sank, a claim for

that may also be problematic. There are three types of ways that

modern boat policies respond in these circumstances: one says 'no' either

way, one says 'yes' if it was a latent defect that caused the loss but

'no' if it was gradual deterioration, and one says 'yes' either way.

insurance claim payment would be made anyhow.

But the failure of even the smallest and least expensive item with a

latent defect can have disastrous consequences. Imagine a hose

clamp installed on the seawater cooling intake hose: whether it fails due

to progressive corrosion years later or fails the week it was installed

because it was not manufactured correctly, not only will a claim be

unsustainable for the loss of the hose clamp, but, if the boat sank, a claim for

that may also be problematic. There are three types of ways that

modern boat policies respond in these circumstances: one says 'no' either

way, one says 'yes' if it was a latent defect that caused the loss but

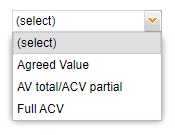

'no' if it was gradual deterioration, and one says 'yes' either way. It is noteworthy that the term 'actual cash value' is used in both total

loss and partial loss categorization. Accordingly, there are three

broad categories of how boat insurance policies pay claims in descending

order of value and premium cost: Replacement Cost up to an Agreed Value;

Actual Cash Value up to an Agreed

Value; Actual Cash Value. Most insurance companies have decided how

they want to cover boat and only offer one type of policy, while others

offer two of these choices; there is only one company that offers all

three options and illustrated here is how they present these choices in

abbreviated form.

It is noteworthy that the term 'actual cash value' is used in both total

loss and partial loss categorization. Accordingly, there are three

broad categories of how boat insurance policies pay claims in descending

order of value and premium cost: Replacement Cost up to an Agreed Value;

Actual Cash Value up to an Agreed

Value; Actual Cash Value. Most insurance companies have decided how

they want to cover boat and only offer one type of policy, while others

offer two of these choices; there is only one company that offers all

three options and illustrated here is how they present these choices in

abbreviated form.